LendingTree

LendingTree Achieves 65% Lower CPAs With Taboola’s Internal Retargeting

How Retargeted Taboola Users Move From Consideration to Conversions

- 100% Higher Conversion Rates

- 65% Lower Cost-Per-Acquisition

Company

LendingTree is an online lending exchange that connects consumers with multiple lenders, banks and credit partners, covering a number of financial borrowing needs.

Challenge

Looking for higher margin opportunities that could maximize the impact of its credit card-related content promotion budgets.

Solution

Incorporate Taboola’s Internal Retargeting capabilities to specifically engage users that were further down the “consideration funnel”.

Results

LendingTree saw conversion rates jump by 100%, and cost-per-acquisitions (CPAs) drop by 65%, across its retargeted Taboola campaigns.

Introduction

LendingTree is a leading online loan marketplace that facilitates competition amongst lenders, banks and credit partners, helping to connect people with a customized loan that best matches their individual needs. Lenders pay for the chance to compete on LendingTree, and the service is provided free of charge to consumers, who can easily browse a variety of options from the comfort of their own homes.

Over the past year, LendingTree has invested resources in a variety of on-site educational materials and landing pages, and its marketing team was looking for a partner that could promote those assets across the web in the most efficient way possible. Taboola’s content discovery platform offered not only a premium site list with high-quality audiences, but also retargeting capabilities that enabled LendingTree to better allocate its spend.

Comparison Articles Educate Consumers and Drive New Purchases

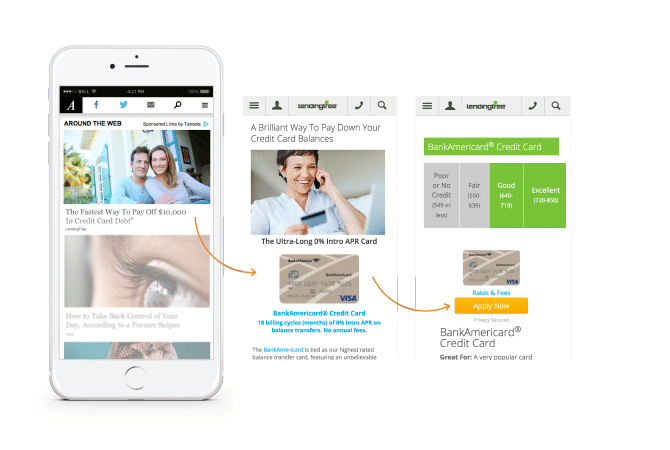

The initial focus of Taboola’s work with LendingTree revolved around the company’s popular comparison-style articles. Each piece introduces an innovative new payment strategy along with an easily digestible breakdown weighing the pros and cons of different credit card options.

In addition to educating consumers about various credit card offerings, these articles also drive new purchases for LendingTree. Consumers can click on cards throughout the piece to learn more about a particular option, and prominent “APPLY NOW” buttons direct them to the appropriate bank website when they’re ready to make a decision.

Internal Retargeting 100% Higher CVRS, 65% Lower Caps

Since enrolling for a new credit card is a relatively complex purchase, LendingTree’s comparison-style articles proved to be a perfect candidate for retargeting campaigns, allowing their team to follow up with consumers who may still be mulling over a decision.

Taboola’s Internal Retargeting capabilities enabled LendingTree to engage only those users that had clicked on a related campaign before, and were therefore more likely to convert. After implementing these new optimizations, LendingTree saw a 100 percent increase in conversion rates (CVRs) amongst retargeted users, and related CPAs dropped by 65 percent.

Working closely with Taboola’s account management team, LendingTree was able to maximize the impact of every cent allocated towards content promotion, unlocking a higher-margin return-on-investment for its credit card marketing. As the company looks to expand efforts around other products, such as mortgages and auto loans, this retargeting strategy will serve as a blueprint for many other campaigns in the future.