iQuanti Home Equity Bank

iQuanti Drives Interest in HomeEquity Bank’s Reverse Mortgage From Over 1,000 People with Taboola Smart Bid

With Taboola Smart Bid iQuanti Decreased CPL for HomeEquity Bank by 48% in Comparison to Other Acquisition Channels

- 110% Increase in Leads with Taboola Smart Bid

- 30% of All Paid Inquiries were Driven by Taboola Since Smart Bid was Released

- 30% Decrease in Cost Per Lead (CPL) in Comparison with Paid Search and Social

Company

iQuanti is the global performance-based digital marketing agency handling end-to-end digital acquisition strategy for HomeEquity Bank Canada—Canada’s leading provider of reverse mortgages.

Challenge

Drive leads for HomeEquity Bank’s Reverse Mortgage product while increasing scale and decreasing overall CPL.

Solution

Implement Taboola’s Smart Bid feature to automatically optimize the baseline bid for every impression.

Results

With Taboola, iQuanti saw a 110% increase in leads after the release of Smart Bid—driving 30% of overall paid inquiries and an 30% decrease in CPL.

Introduction

iQuanti is a global performance-based digital marketing agency for every vertical, product and brand strategy. Among others, iQuanti handles end-to-end digital marketing strategy for HomeEquity Bank Canada.

HomeEquity Bank is a Federally regulated, Schedule 1 Canadian Bank. It was founded in 1986 and has since been serving Canadians for over 30 years. HomeEquity Bank understands the needs of Canadians age 55 and over. With a conservative approach to lending practices, HomeEquity Bank provides Canadians with the security and high regulatory standards that come with being a Canadian bank.

With Taboola Smart Bid iQuanti Decreased CPL for HomeEquity Bank by 48% in Comparison to Other Acquisition Channels

Prior to working with Taboola, iQuanti faced challenges scaling the number of leads for HomeEquity Bank’s campaign. Channels like paid search and social, GDN, Yahoo and Zemanta were driving results with high costs per click and acquisition, as well as low conversion volume.

To achieve HomeEquity Bank’s conversion goals, iQuanti ran multiple campaigns with different targeting tactics—including audience segmentation, retargeting and audience segmentation.

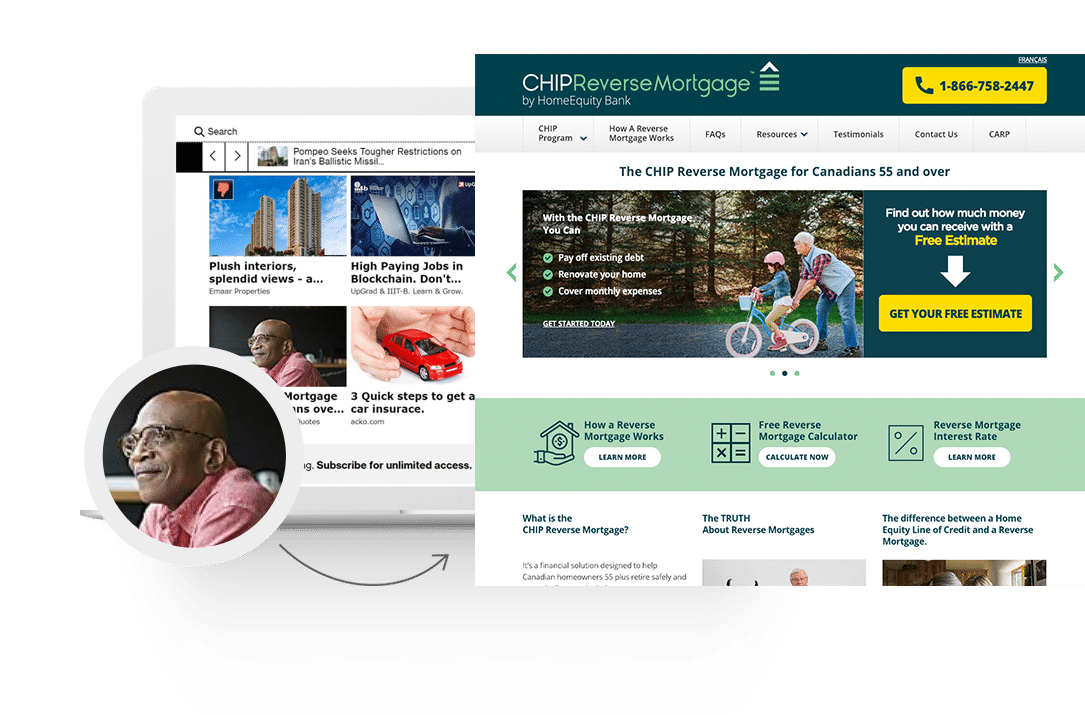

These campaigns promote HomeEquity Bank’s mortgage product, known among Canadian Seniors as CHIP (Canadian Home Income Plan). The campaign captures leads through dedicated landing pages.

In order to drive more leads, iQuanti further optimized their campaign using Smart Bid. Smart Bid is Taboola’s bidding feature that helps maximize campaign performance by automatically adjusting the baseline bid of every impression based on the likelihood to drive conversions or page views.

Taboola Drives 30% of All Paid Leads for HomeEquity’s Campaign

The release of Smart Bid happened in tandem with the implementation of Taboola Pixel, giving iQuanti advanced tracking capabilities. With Smart Bid, iQuanti was able to achieve higher scale, more conversions and a lower CPL. With Taboola, iQuanti saw a 110% increase in leads after the release of Smart Bid—driving 30% of overall paid inquiries and an 30% decrease in prospecting CPL.

iQuanti is happy with Taboola’s account management team, who has worked closely with them to provide optimization and creative advice. “Taboola’s Account Management team has worked closely with us & helped us through our journey to make the best of the platform.”